Sunil Tuli

President of APTRA

Sunil Tuli, President of the Asia Pacific Travel

Retail Association (APTRA) & Group Chief

Executive, King Power Group (Hong Kong) shares

his perspective on the importance of travel retail

within the Indian aviation industry.

The Travel Retail and Duty Free market in India is

the fastest growing in the global industry. The

sector plays a critical role in the country’s aviation

market, providing essential non-aeronautical

revenue for airports and playing a pivotal role in

the government’s ambitions for growth. The

surge in the middle classes and in Gen Z

constitute a powerful and appealing consumer

target base for luxury brands, airlines and

airports. The increasing demand for air travel

from consumers keen to travel the world has also

made India a priority source market for tourists in

many countries who are keen to invest in-market

to attract even greater numbers of Indian visitors.

The number of operational airports across the

federation has more than doubled from 74 in

2014 to 157 in 2024, and the government claims

that this could increase to almost 400 by 2047.

India’s Public-Private Partnership (PPP) model is

further expanding the number of new airports

and airport expansions, with over a dozen

currently operating this model, and the Ministry

of Civil Aviation is developing PPP modalities for

the privatisation of 25 airports under the National

Monetization Pipeline plan.

The government’s long-term strategic planning

programme is a comprehensive, joined-up

approach that aims to develop transport

infrastructure by recognising the

interdependence of air, road, rail and water

transport. Aviation is a key priority and is founded

on the UDAN policy, rapidly expanding domestic

air travel accessibility to the wider population.

Building on the successful expansion of major

airports, this policy has significantly increased

connectivity to smaller Tier 2 and 3 cities and

remote areas, making flying an everyday

convenience accessible to a much larger

proportion of the population.

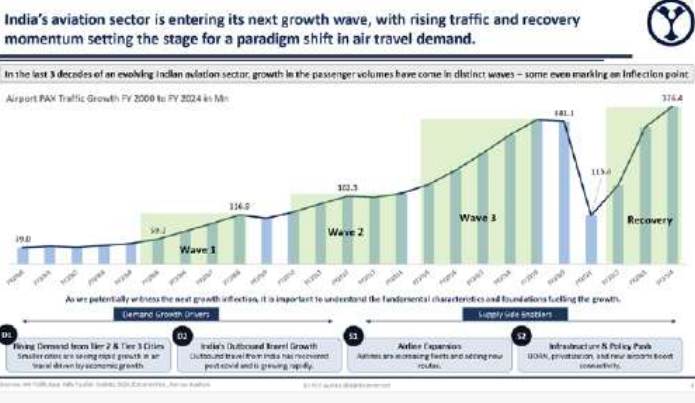

- Traffic totalled 376.4m in FY2024 (domestic and international)

- Non-metro airports account for nearly 40% of total passenger traffic, with 146 million passengers in FY24.

- Outbound travel is projected to reach 52 million by 2029, with a CAGR of 11.5%

The ambition to provide financially viable

regional flight routes with capped airfares is

inevitably complex in its influence on the market,

but these routes aim to connect over 100 smaller

airports in towns to India’s major cities. This also

includes seaplanes and helicopter services.

Similarly, the National Air Cargo Policy has aided

the development and expansion of the country’s

cargo operations, strengthening India’s position

as a logistics powerhouse and, linking with the

huge focus placed on the technology sector and

education – especially in expanding the female

workforce- is facilitating the rapid growth of

e-commerce. One remarkable example of the

success of the strategy is the fact that the

comprehensive planning and new thinking

behind India’s growth of its aviation system has

resulted in 15% of India’s pilots being female, far

above the global average of around 5%.

Government initiatives like UDAN and regional

airport privatisation are unlocking new markets,

with non-metro airports now accounting for

nearly 40% of total passenger traffic. Outbound

travel is also surging, with international

departures expected to reach 52 million by 2029,

positioning India as the fastest-growing source

market in South Asia. The expansion is unlocking

new market access and bringing emerging

traveller segments into the market and

influencing retail trends from Dubai to Denpasar.

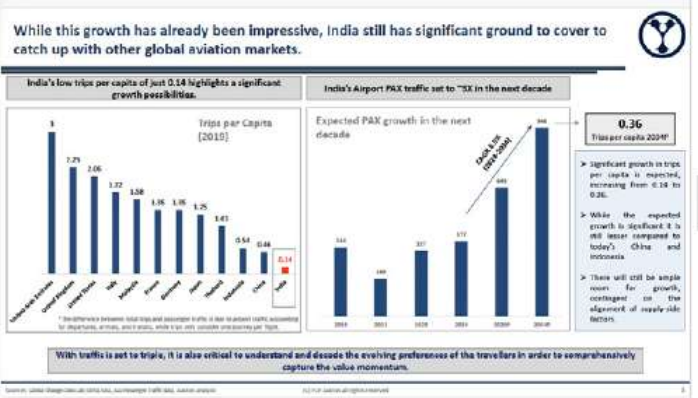

While India’s growth is clearly impressive, it is

rising from a relatively low base and, in everything

from earnings per capita to annual passenger

numbers and flights per capita, the country still

has far to go to overtake China, for example – but

it is a huge country with an increasingly affluent,

young population that prioritises international

travel and discovery.

India’s airports – transforming capacity and the

passenger experience

Central to the country’s aviation focus is the

positioning of India’s major airports as hubs

connecting the East and the West. The

international airport experience has been

transformed in India, led by stunning locations

such as Delhi Indira Gandhi International Airport

(profiled in Airport World, Issue 2, 2025) where

operator DIAL has developed what it describes as

‘a bigger, better, smarter, and future-ready’

airport by blending a capacity of 100 million per

annum (with the potential to rise to 140 million)

with quality in its ASQ award-winning passenger

experience. The airport has a continuing

programme of major developments planned for

the next decade to strengthen its role as India’s

‘flagship hub’.

Similarly, Bengaluru International Airport has

created an even more expansive transformation,

setting a global benchmark with new levels of

customer service in the remarkable T2 – the

‘terminal in a garden’ – that shares a stunning

celebration of the city’s culture, heritage and

people. Major investment developments at

Mumbai, Chennai, Bengaluru, Kolkata, and

Hyderabad are also strengthening India’s

ambition to be a competitive hub to the GCC.

Leading the way for infrastructure essential to

achieve India’s growth ambition is Navi Mumbai,

the largest of seven major new population centre

developments, supported by a new airport, Navi

Mumbai International Airport, that will start

operating commercial flights in the next few

months following its official inauguration in June.

With an initial capacity of 20 million passengers, it

will expand to 50 million by mid-2029 following

the addition of another terminal and runway.

Subsequent planned phases will reach an

eventual goal of 90 million pax by 2036.

Jewar Airport, Noida, with six runways planned, is

envisioned to become India’s largest airport and,

though delayed, the first phase is scheduled to

open soon and will help ease the pressures on

capacity at Delhi Indira Gandhi International

Airport.

Airline growth

In tandem with the country’s transport policy,

India’s airlines leading the global industry in

aircraft orders to utilise those airports, collectively

placing orders for approximately 1,700 aircraft to

be delivered by 2030.

Last December, Air India augmented its existing

mandate of 470 planes by an additional 100,

reflecting its confidence in the long-term market.

With new airports and new aircraft come new

travellers – including an anticipated year-on-year

growth rate of 5-6% in traffic.

Non-Aeronautical Revenue opportunities

With those 40,000 new passports expanding the

potential travel market every single day, Indians

are passionate about international travel, and this

desire for new experiences brings them right to

Travel Retail’s shop window. India’s middle classes

have a passion – and the wallet – to travel the

world. Consumer spending abroad has reached

record levels, and the good news for the aviation

and travel retail sectors is that their spending

priority is foreign travel, increasing from 37% of

spend in 2020 to 53.6% in 2024, a rise of almost

25% year-on-year to 17 billion dollars in 2024.

The dynamic landscape of travel retail in India is

undergoing a significant transformation. With

Arrivals stores accounting for approximately 80%

of travel retail income generation in the country,

the product assortment is rapidly expanding

beyond traditional categories such as spirits and tobacco.

Beauty is emerging as a strong

contender for the leading category, while

confectionery, wellness, toys and tech are steadily

gaining retail prominence at major airports.

Indian travellers are increasingly drawn to luxury

brands that offer personalisation, immersive

experiences and contemporary cultural

relevance. To meet these evolving consumer

expectations, retailers are elevating their

offerings, ensuring they stand out from other

retail channels to deliver a differentiated

shopping experience.

Evolving Consumer Behaviour

- Rising incomes and aspirations are reshaping travel and retail consumption patterns in India.

- Gen Z and Millennials are key influencers, prioritising experiential and ethical consumption.

- The affluent class is expected to double, driving demand for luxury and discretionary spending.

- Consumers are shifting from price-driven to brand-conscious and experience-oriented purchasing behaviours.

- Digital convenience and sustainability are becoming essential for engaging modern travellers.

www.aptra.asia

India’s Gen Z, already numbering 380 million –

surpassing the entire population of the USA – is

rapidly gaining influence. By 2035, this

demographic is projected to become the largest

of its kind globally and is expected to drive 50%

of consumer spending decisions in India.

This is a perfect expression of the new India. A

new mindset among the middle-class consumers

and a signal of their determination to not only

enjoy new travel and consumption experiences

but also to celebrate an exciting, more global

citizenship.

Among India’s new middle class, there’s surging

interest in brands, especially international icons.

Just as those middle-class consumers are fuelling

India’s economic rise, so too will they play a lead

role in driving the future success of India’s

aviation sector.

APTRA represents the travel retail industry across

over 45 markets in Asia Pacific with advocacy and

regulatory services, networking, knowledge and

research through events such as the APTRA India

conference scheduled for Bangalore in March

2026 and the APTRA North Asia Forum in Hong

Kong 3-5 December 2025.